Do I Have to Report DoorDash Income?

Last updated

Wondering if your earnings from zooming around town, delivering people’s favorite eats need to be reported to the tax man? You’re in the right place.

Let’s dive into whether you need to report the money you make from DoorDash.

Yes, You Must Report DoorDash Income

Just like any other job, if you’re making money by delivering with DoorDash, you’ve got to report it on your taxes. It’s all about keeping things square with Uncle Sam.

DoorDash pays its drivers part-time wages, and you can even earn tips through the app. Both are forms of income that the IRS wants to know about. Why? Because whether it’s a hundred bucks or a few thousand, it all adds up in their books.

Earning Rewards While Reporting Income

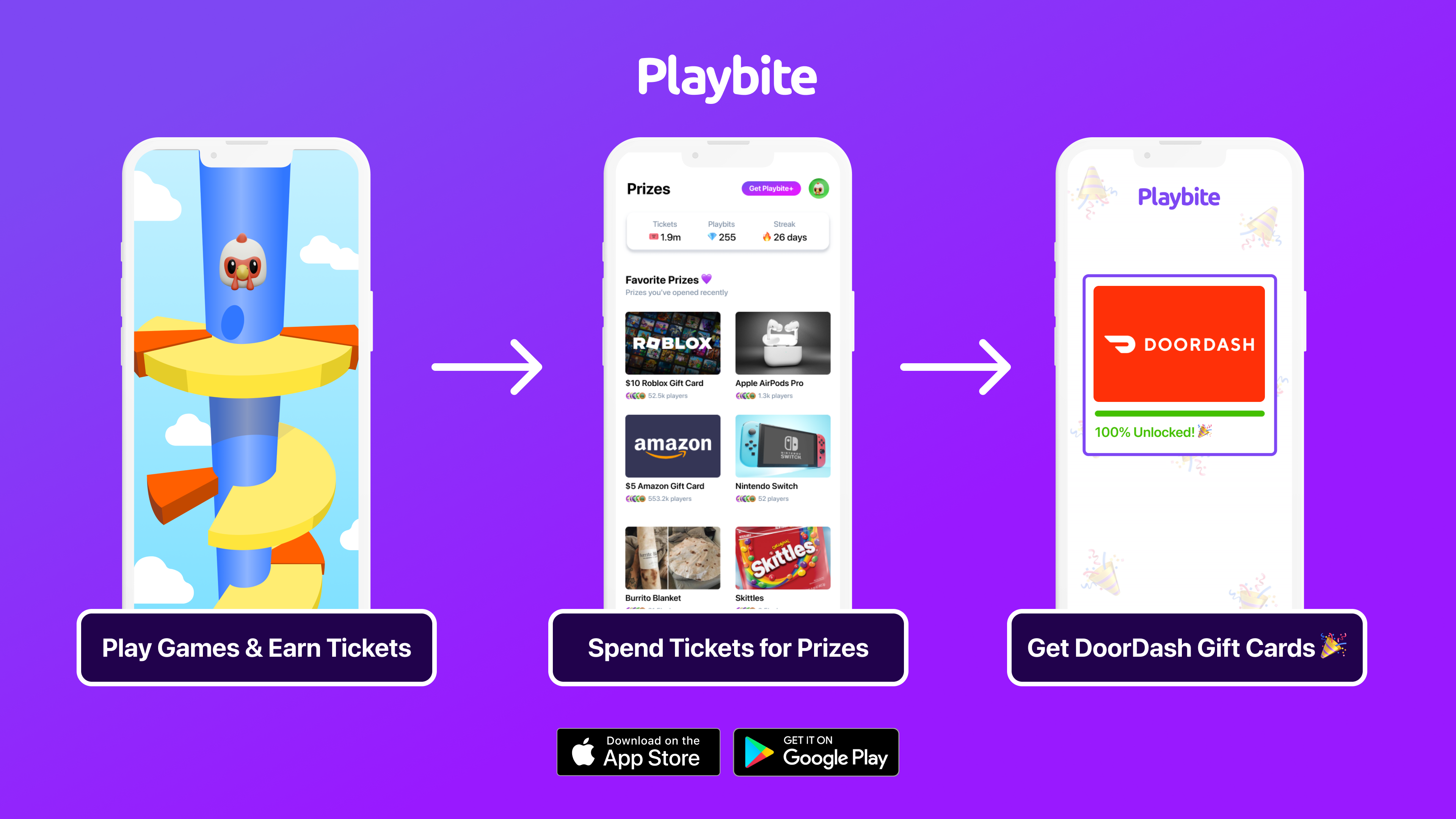

Now, here’s where it gets exciting. While staying on top of your DoorDash income reporting, did you know you can earn sweet rewards with Playbite? That’s right! By playing fun and casual mobile games through the Playbite app, you can score official DoorDash Gift Cards. Imagine earning while enjoying your favorite games and then getting to spend on your favorite meals. It’s a win-win!

So, why not download the Playbite app today? Besides the chance to get DoorDash Gift Cards, you’ll find a fun way to pass time, compete with friends, and possibly even treat yourself to a nice meal after a long day of deliveries. It’s all about making those errands more rewarding.

In case you’re wondering: Playbite simply makes money from (not super annoying) ads and (totally optional) in-app purchases. It then uses that money to reward players with really cool prizes!

Join Playbite today!

The brands referenced on this page are not sponsors of the rewards or otherwise affiliated with this company. The logos and other identifying marks attached are trademarks of and owned by each represented company and/or its affiliates. Please visit each company's website for additional terms and conditions.