Does Clash of Clans Charge Tax?

Last updated

Wondering if your favorite strategy game, Clash of Clans, tacks on any extra charges in the form of taxes? Let’s dive straight into this intriguing question and clear up any confusion.

Does the popular mobile game Clash of Clans include any additional charges that could be considered a tax when you make in-game purchases? We’re here to provide the answers you’re looking for.

Short Answer: No Direct Tax

Clash of Clans itself does not directly charge any tax on the purchases you make within the game. When you’re buying gems, or any other in-game resources like Gold, Elixir, or Dark Elixir, the price you see is typically what you pay.

However, it’s important to note that depending on your country or region, tax laws might require the platform (like Google Play Store or Apple App Store) through which you make the purchase to apply sales tax. This means while Clash of Clans doesn’t add tax, the final price you pay may include it, depending on local laws.

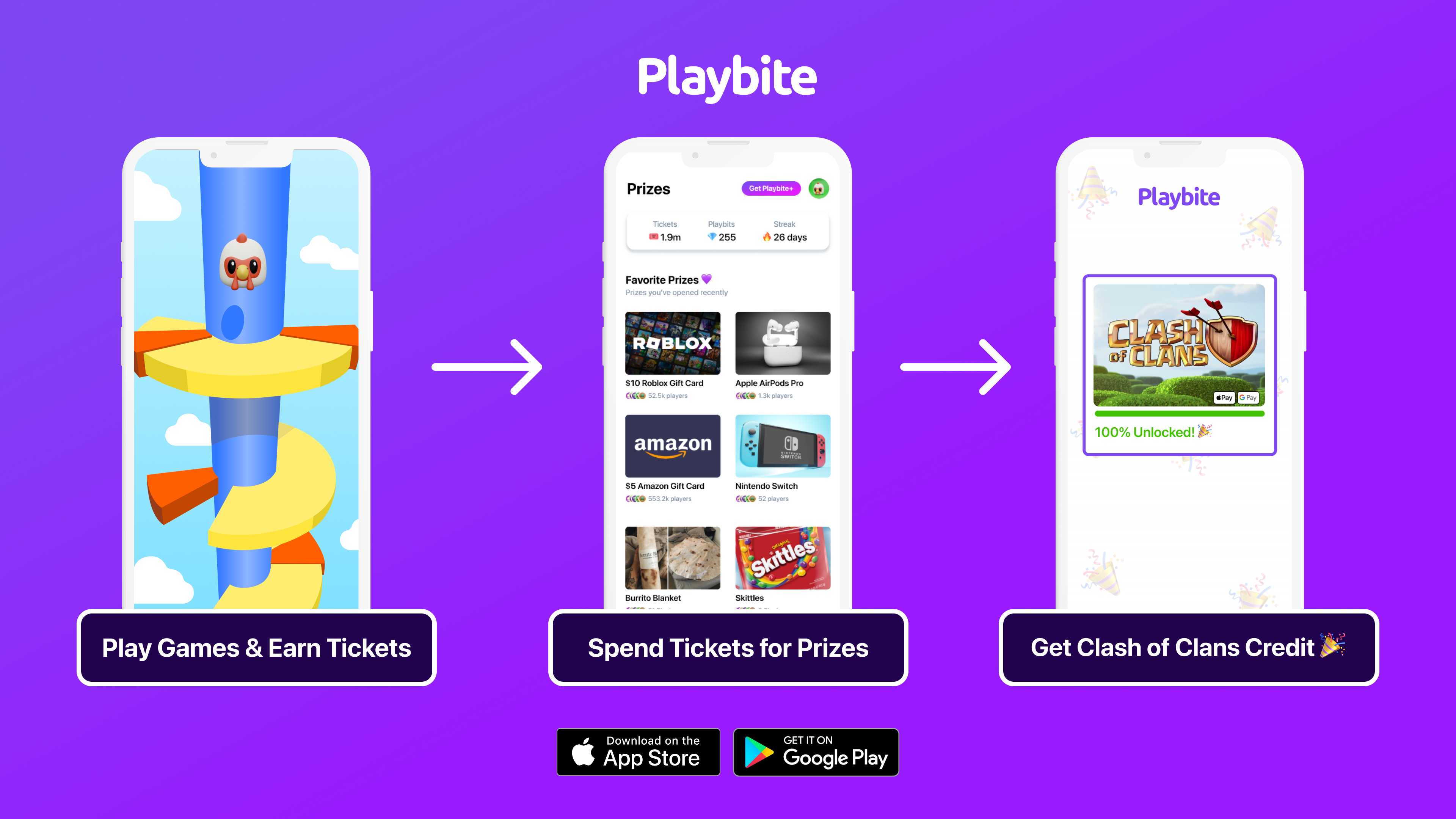

Play Clash of Clans and Earn with Playbite

Now that you know Clash of Clans keeps your gem shopping spree free from direct taxes, how about adding more fun and rewards to your gaming experience? With Playbite, you can play casual mobile games and earn rewards that can be used in games like Clash of Clans! Imagine earning extra gems, Gold, Elixir, or Dark Elixir for your village just by having fun.

Why wait? Download the Playbite app now and start playing games to earn rewards. It’s a fantastic way to enhance your Clash of Clans experience without spending extra. Who knew playing more games could lead to conquering more villages?

In case you’re wondering: Playbite simply makes money from (not super annoying) ads and (totally optional) in-app purchases. It then uses that money to reward players with really cool prizes!

Join Playbite today!

The brands referenced on this page are not sponsors of the rewards or otherwise affiliated with this company. The logos and other identifying marks attached are trademarks of and owned by each represented company and/or its affiliates. Please visit each company's website for additional terms and conditions.