Does Lululemon Have Tax Free Weekend?

Last updated

Ever wondered whether Lululemon joins in on the excitement of tax free weekends? Let’s dive into this question and uncover the answer.

So, you’re curious if Lululemon offers sales without taxes during that special weekend? You’re in the right spot to find out.

Quick Answer: It Depends on Your State

Whether Lululemon participates in tax free weekends largely depends on the specific rules and dates of the state where the store is located. Tax free weekends are a state event, not a store-specific one.

Generally, if your state has a tax free weekend and it includes clothing as an eligible category, then yes, Lululemon stores in that state should offer tax-free purchases on qualifying items. Remember, each state has its own guidelines on what counts as a tax-free item and the price limit for these items.

How This Ties Back to Playbite

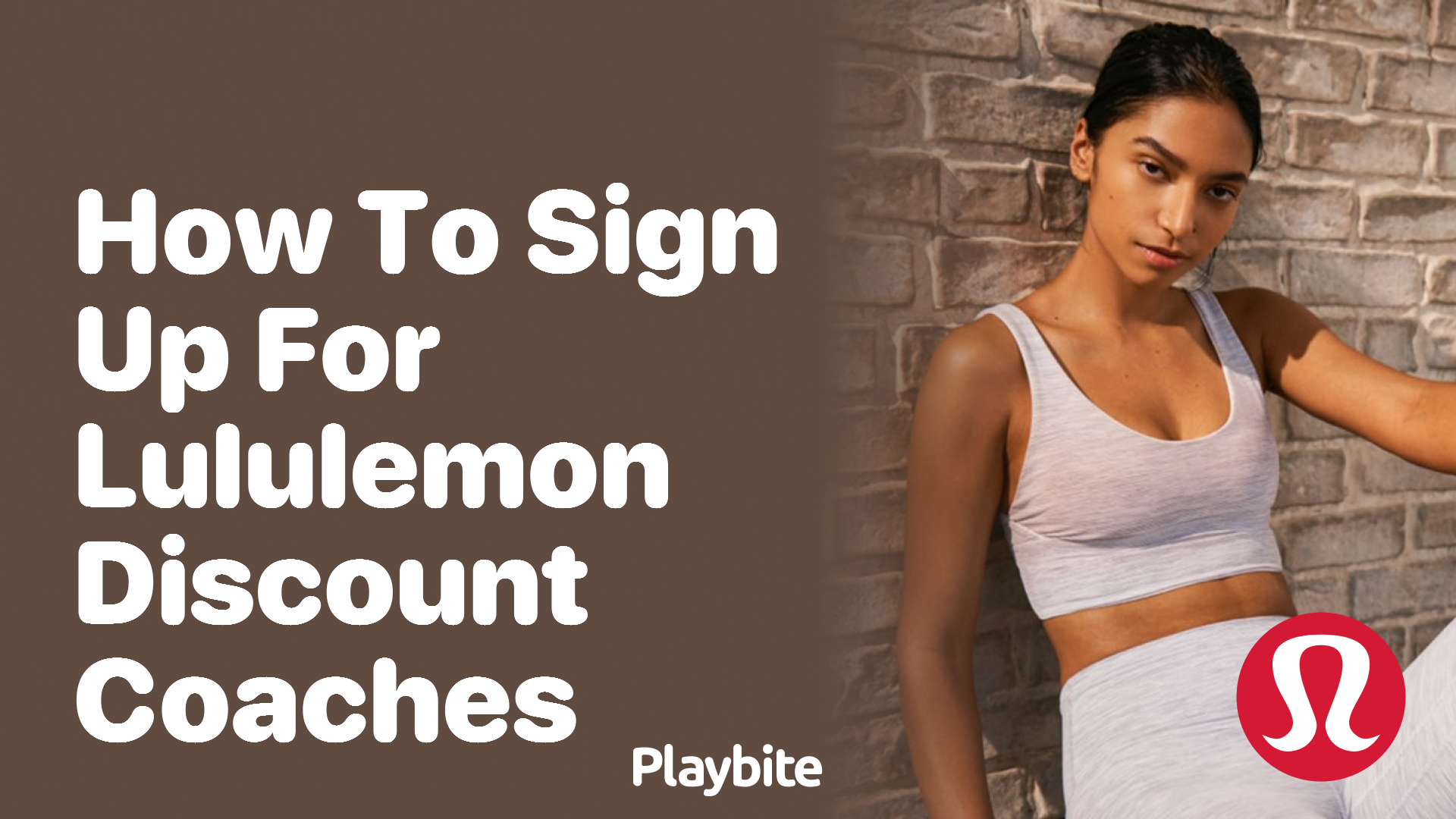

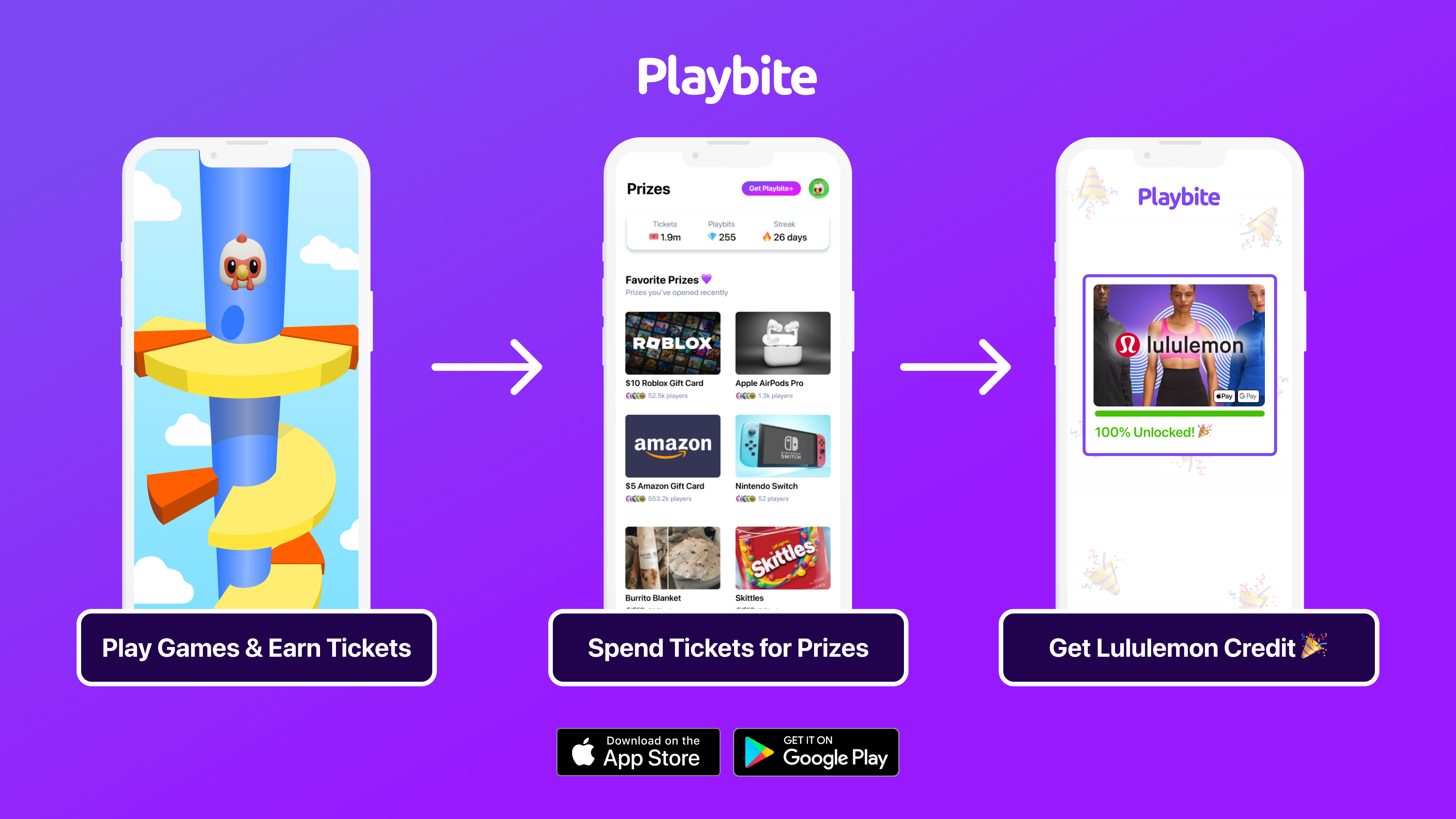

Now, let’s connect the dots to Playbite. Imagine not only enjoying tax-free shopping at Lululemon but also snagging a Lululemon Gift Card just by playing fun games. By downloading the Playbite app, you enter a world where those premium Lululemon items could be yours without even spending a dime. Playing games on Playbite can lead to winning official Lululemon Gift Cards – adding more joy to your shopping spree!

In case you’re wondering: Playbite simply makes money from (not super annoying) ads and (totally optional) in-app purchases. It then uses that money to reward players with really cool prizes!

Join Playbite today!

The brands referenced on this page are not sponsors of the rewards or otherwise affiliated with this company. The logos and other identifying marks attached are trademarks of and owned by each represented company and/or its affiliates. Please visit each company's website for additional terms and conditions.