How Much Do 10 V-Bucks Cost with Tax?

Last updated

Ever wonder how much 10 V-Bucks would set you back, especially after tax? Well, you’re not alone! Getting down to the nitty-gritty of what 10 V-Bucks cost, including tax, can help gamers plan their next in-game purchase in Fortnite.

Let’s dive into figuring out the cost of 10 V-Bucks once tax comes into play.

The Short Answer: It Depends

First off, the cost of V-Bucks isn’t a one-size-fits-all answer. The price can vary because of where you live. Remember, 1 V-Buck is roughly equal to $0.0079900 in the US. So, 10 V-Bucks would be around $0.0799 before any tax.

But, when it comes to tax, every state or country has its own rate. That means the final price after tax depends on where you’re buying your V-Bucks from. Generally, you might pay a few cents more once tax is added to those 10 V-Bucks.

Connecting V-Bucks and Playbite

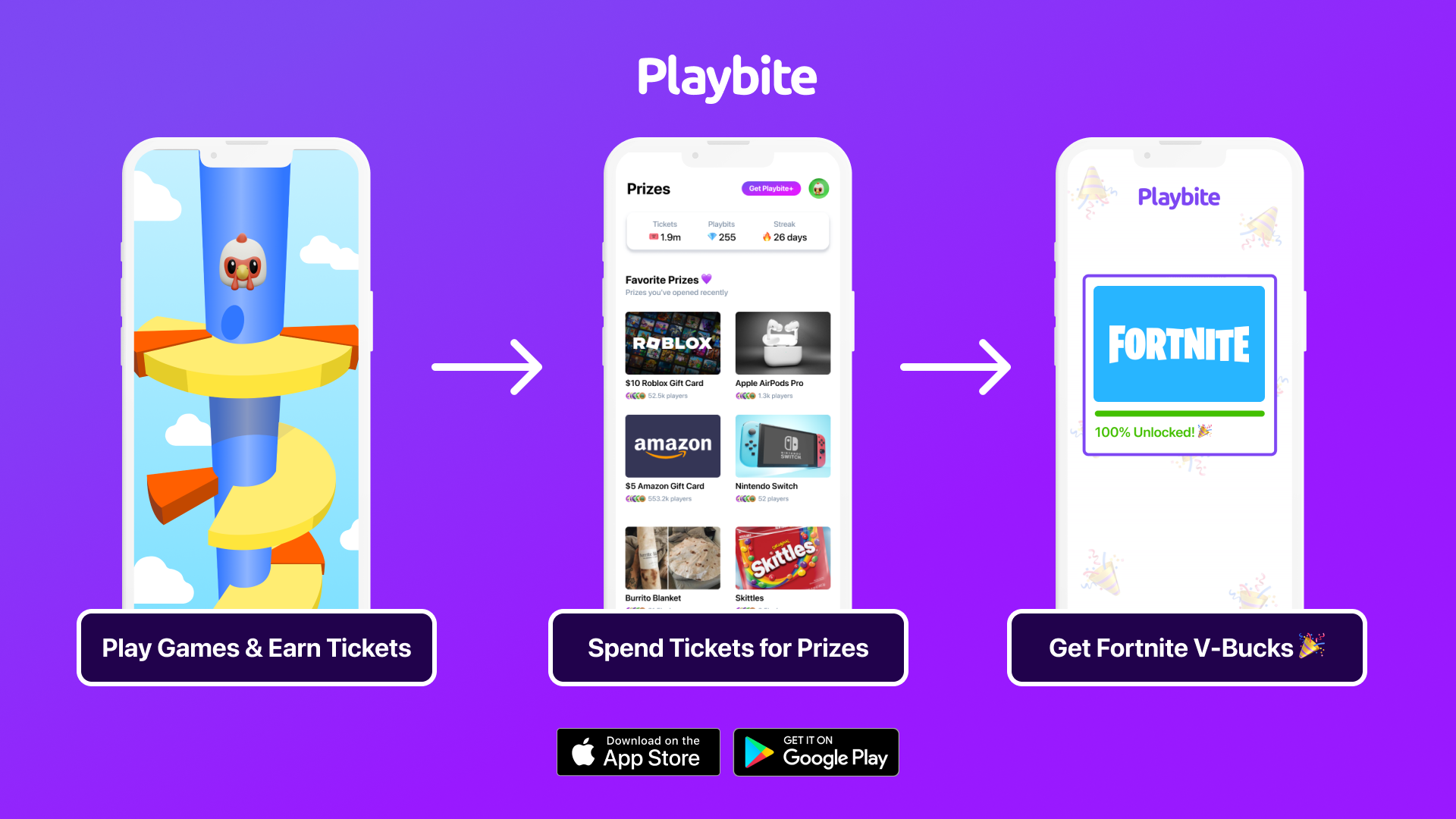

Now, if you love playing Fortnite but wish there was a way to get V-Bucks without directly paying for them, Playbite might just be your new best friend! Playbite is an app that rewards users with real prizes, including official Fortnite gift cards, for playing fun mobile games. Yes, you heard that right. You can win V-Bucks by playing games!

Why not download the Playbite app today? Not only do you get the chance to earn V-Bucks and other awesome rewards, but you also get to have a blast playing casual games. It’s a win-win situation for any Fortnite fan looking to score some extra in-game currency without reaching for their wallet. Who knows? You might just land enough V-Bucks for your next big in-game purchase!

In case you’re wondering: Playbite simply makes money from (not super annoying) ads and (totally optional) in-app purchases. It then uses that money to reward players with really cool prizes!

Join Playbite today!

The brands referenced on this page are not sponsors of the rewards or otherwise affiliated with this company. The logos and other identifying marks attached are trademarks of and owned by each represented company and/or its affiliates. Please visit each company's website for additional terms and conditions.